Sometimes whipping up your next great meal doesn't come so easily, and we believe one of the best things you can do for some recipe inspo is to turn towards the works of a great chef!

Jamie Oliver is one such muse, having authored a library of cookbooks, hosted several TV series, and produced a near countless number of recipes. With all of this material it can be tough to nail down the best Jamie Oliver recipes--after all, where do you even start with this guy!

For this reason, we have done the legwork for you and assembled a countdown of the top 25 best Jamie Oliver recipes. We're here to pay homage to one of the greats by highlighting this countdown of his most crave-worthy recipes, as well as offering a few of our own best tips and tricks for pulling them off!

Table of Contents

Who is Jamie Oliver?

Born in Essex, England, Jamie got an early start honing his culinary skills when he began working at his family’s restaurant as a teenager. It wasn’t long before his affinity for cooking on camera was noticed and a network picked him up for his first cooking show, The Naked Chef, in 1999.

Almost instantly, Jamie Oliver achieved celebrity status and became a household name, going on over the years to produce other television programming, books, and magazines as well as opening a slew of restaurants.

Though he worked (and continues to work!) through a wide variety of outlets within the food industry, one thing has remained constant throughout Jamie Oliver’s career: teaching and sharing relatable, delicious recipes with home chefs of all skill levels.

25 of Jamie Oliver’s Best Recipes

1. Jamie Oliver Yorkshire Pudding: “Amazing Yorkies”

Also known as popovers in many regions, these airy yet crisp baked goods are unmatched when it comes to textural delight. The key to that perfect crispy-on-the-outside yet fluffy-on-the-inside result is to allow the vegetable oil (choose something like grapeseed oil or an equally neutral grapeseed oil substitute) to get very hot in the oven before you add your batter.

While Yorkshire puddings are part of a traditional holiday meal for many folks, there’s no need to wait for a special occasion when the recipe is as simple as Jamie Oliver’s! Enjoy them for breakfast with your favorite strawberry jam, or whip up a batch of our Simple 3-Ingredient Strawberry Jam while you wait for your “Yorkies” to rise.

2. Jamie Oliver Paella: “Paella with Chicken, Chorizo, Mussels & Prawns”

This paella is loaded! It calls for rich and tender chicken thighs, spicy chorizo, sweet prawns, and fresh mussels. The dish gets a few pops of bright green thanks to the addition of frozen peas and the whole thing is perfumed by aromatic saffron and smoky paprika.

The beautiful thing about a recipe like paella is that you can easily tailor it to suit your tastes. If you don’t eat red meat, simply omit the chorizo. Or, if you’re not a shellfish person, toss in a bit of extra chicken instead.

Now is the time to break out that paella pan if you have one! If you don’t, feel free to make use of any wide, deep pan that is large enough to accommodate all of those amazing ingredients.

3. Jamie Oliver Brownies: “Cherry Brownies”

What’s better than a freshly baked batch of brownies? How about cherry chocolate brownies. With the addition of fresh cherries and roasted pecans (not to be confused with walnuts, although, they would make for an equally delicious substitute), these brownies feel so special, it seems hard to believe they’re ready from start to finish in just 20 minutes!

Want to turn the dial up just a wee bit further? Whip up a batch of Homemade Dark Chocolate using our recipe, and use it where dark chocolate is called for in Jamie’s recipe for Cherry Brownies. Trust us, it’s worth your time.

4. Jamie Oliver Pizza Dough: “Pizza Dough for Beautifully Crispy Pizzas

Making pizzas at home is one of our favorite ways to have fun with dinner and it is especially good for encouraging young chefs to create their own flavor combinations and try new ingredients along the way! And, once you have the pizza dough down, the sauce and toppings come quite easily, making this meal a simple one to pull off.

Special equipment is not required for homemade pizza-making, but there are a few things that do make the task a bit easier. A pizza stone helps to cook your pizza dough evenly and deliver that crispy crust, while a pizza peel will make the job of transferring rolled dough or cooked pies that much easier!

5. Jamie Oliver Fish Pie: “Fantastic Fish Pie”

When it comes to fish pie, Jamie Oliver without a doubt takes the cake. Think shepherd's pie, with that rich mashed potato topping that is golden-browned to perfection in the broiler--except instead of red meat, this one is filled with heart-healthy, omega-3 rich fish!

This recipe calls for haddock or cod, which holds its shape nicely during cooking, as well as plenty of onion, carrot, and fresh baby spinach for even more wonderful health benefits.

This one might take a bit of time to make (about an hour plus cooling time), but we love that once it’s in the oven, you can forget about it while it bakes. Plus, the leftovers store extremely well and might just taste even better the next day!

6. Jamie Oliver Veggie Chilli: “Veggie Chilli with Crunchy Tortilla and Avocado Salad"

With a cooking time of just 15 minutes, Jamie Oliver’s veggie chilli is one quick and easy meal. Chock full of chickpeas, black beans, and rice, this dish both satisfies and nourishes. It takes on big flavors thanks to both coriander and cumin, as well as a healthy dose of sweet smoky paprika. Don’t worry if your spice rack isn’t quite up to snuff though! There are plenty of substitutes for paprika in case you’ve run out or would prefer the taste of something else.

A cool green salad accompanies this hot dish, with a refreshing avocado-lime dressing and dollops of soothing yogurt. The recipe only calls for about 3 tablespoons of yogurt, so go ahead and freeze the rest of that yogurt container for another use!

7. Jamie Oliver Waffles: “Brilliant Breakfast Waffles”

If you don’t yet have a waffle maker at home, this is your sign to get one because this breakfast waffle recipe from Jamie Oliver is indeed, brilliant. Not only is it a cinch to pull off (10 minutes to fresh waffles!) but they are highly adaptable and can be used as either “sweet or savoury”, as the chef offers different topping options from fried eggs with bacon and ketchup to fresh blueberries with honey and lemon.

The recipe calls for vanilla extract but feel free to use any of our vanilla extract substitutes such as whole, fresh vanilla beans or spice things up with cinnamon extract!

8. Jamie Oliver Roast Potatoes: “Best Roast Potatoes with Garlic and Sage”

Looking for a recipe for perfect roasted potatoes that will serve a crowd (up to 10 people!) and that requires minimal effort on your part? Look no further. These roast potatoes from Jamie Oliver offer that perfect juxtaposition of crispy golden-brown crust and light, fluffy, moist interior.

Aside from the potatoes themselves you need just a few more ingredients: olive oil, garlic, fresh sage, and butter. Make sure to use garlic which has been stored properly, as the intent in this recipe is that you can serve and eat the whole, caramelized garlic cloves right alongside the potatoes in the finished dish.

9. Jamie Oliver Flatbread: “Homemade Flatbreads”

We don’t blame you if the idea of any sort of bread-baking seems a bit overwhelming, after all, there are people who spend their entire careers perfecting the art of baking the perfect loaf of bread! Thankfully though, making flatbreads is a much easier and more approachable foray into the world of baking.

This Jamie Oliver flatbread recipe can be whipped up in just 20 minutes (be sure to allow an extra 45 minutes for the dough to rest first!) and makes a cozy accompaniment to our favorite chilly day dishes like Couscous with Tandoor Vegetables and Halloumi or Vegan Moroccan Lentil Soup.

10. Jamie Oliver Cottage Pie: “Allotment Cottage Pie”

When it comes to cottage pie, Jamie Oliver has it nailed down. Traditional cottage pie typically calls for ground beef, but this version uses hearty green lentils instead, which are not the same as split peas--so don’t be tricked by their appearance!

Despite this major diversion from tradition, this dish is still the ultimate in comfort food, consisting of rich and savory vegetables in an herbaceous, cumin-spiced broth and a perfectly broiled mashed potato topping! One such vegetable this recipe calls for is “swede”, known more commonly as the rutabaga, often mistaken for but a distinct relative of the turnip.

11. Jamie Oliver Potato Salad: “Cypriot-Style Potato Salad”

Jamie Oliver has a ton of different potato salad recipes, but this version inspired by the Greek island of Cyprus is a standout in our eyes! It’s vital to use fragrant Greek olives such as Kalamatas here, as their unique flavor and texture characteristics are an important feature of the dish, as opposed to those more standard black olives.

In addition to the salty, fruity bite of those olives the recipe also calls for a briny punch of capers. If you don’t have them or would prefer something a little different, try one of these caper substitutes.

12. Jamie Oliver Sausage Pasta: “Sausage Pasta with Broccoli, Chilli & Sweet Tomatoes”

Jamie Oliver’s sausage pasta is one of his most sought-after recipes. It has a nice kick thanks to the inclusion of hot red chili peppers as well as chipolata, a type of spicy sausage. If hot red chilis are a little much for you, opt for more mellow jalapenos or one of these substitutes, and if you can’t find chipolata in your area, give chorizo a shot!

All of this heat is balanced by crunchy broccoli, perfectly cooked tagliatelle pasta, and a big ol’ shower of salty parmesan cheese. And, once you’re done making it rain, let us help you get that cheese grater clean the hassle-free way.

13. Jamie Oliver Kimchi: “Kimchi, a Korean Favorite”

Kimchi has long been one of the best kept secrets of the culinary world, but not for much longer! This dish of spicy, fermented cabbage is especially prized for its versatility--use it as a condiment, side dish, or ingredient!--as well as its high concentration of gut-healthy bacteria.

This recipe calls for gochugaru, a type of Korean chili flake, but you can substitute gochugaru with any number of other fiery ingredients if you don’t have the stuff. In his recipe, Jamie encourages you to make this one your own, tailoring the spice level and specific seasonings to suit your tastes. The key is to keep the mixture covered and at a stable temperature for 2-5 days which allows the fermentation to take place.

While you can freeze cabbage, we don’t recommend using frozen cabbage to make this recipe, as the freezing and defrosting process could negatively impact the fermentation as well as the resultant texture of your kimchi. Use that frozen cabbage for another purpose!

14. Jamie Oliver Chocolate Porridge: “Chocolate Porridge with Greek Yoghurt and Fresh Seasonal Fruit”

Whether you call this dish porridge or you think of it as oatmeal, you’re right on both counts, as oatmeal is actually one popular type of porridge. However, if you think of porridge as a simple breakfast food, this is where you’d be wrong, as Jamie Oliver is out to convince you otherwise!

This creamy dessert takes its rich, chocolatey flavor from quality cocoa powder as opposed to chocolate, keeping the sugar content nice and low. Jamie recommends that you serve his Chocolate Porridge with a dollop of thick yogurt and a heap of fresh fruit, but we think some chopped frozen strawberries are an especially refreshing touch. After all, what goes together better than strawberries and chocolate!

15. Jamie Oliver Thai Green Curry: “Thai Green Curry with Roasted Squash, Leftover Greens, Tofu & Peanuts”

One look at the ingredients list on this one and you might think to yourself, “wow, what isn’t in this dish?!” Though the ingredients list is long, it is also (thankfully) extremely flexible. You can use any cooked leafy greens you like or have laying around--perhaps some leftover Smashed Brussels Sprouts or Steamed Spinach. This recipe is also a great place to use your favorite canned spinach, as it is already cooked yet will benefit greatly from the other tasty flavors going on in the curry!

It also calls for tofu which is to be pan-fried until crisp. This may be a new ingredient and/or cooking technique to some, but once you get the hang of it, you’ll make it time and time again! Check out our full guide to frying tofu for some additional tips.

16. Jamie Oliver Cheesecake: “My NYC Cheesecake”

In a slightly tropical twist on classic cheesecake, Jamie Oliver makes his “NYC Cheesecake” with plenty of fresh limes, whole vanilla bean, and grated coconut. You’ll need about a half-dozen limes for this recipe so it’s vital that you know how to store them properly so as to maintain the freshness of their zest and juice.

A springform pan is also required, as it is when cooking just about any cheesecake recipe. It may not be the most common kitchen item but they are extremely affordable and worth adding to your collection of baking tools! And, if you're lucky enough to have any leftovers of this decadent dessert, be sure to check out our full guide to cheesecake storage and shelf life!

17. Jamie Oliver Turkey: “Jamie’s Easy Turkey”

The thought of cooking a meal such as whole roast turkey might sound overwhelming at first, but with Jamie’s Easy Turkey recipe, you truly don’t need any special tricks to impress your guests. This dish is simply seasoned with a few complimentary accompaniments: some root vegetables, a clementine (or another citrus), and “woody” herbs like rosemary or one of these rosemary substitutes.

As far as tools go, be sure to use a good quality meat thermometer to ensure that your bird is cooked to the optimal temperature before removing it from the oven--this recipe calls for a reading of 70℃ (which is about 158℉). This may sound a bit low, but rest assured that the meat will finish cooking as it rests. Also, to make sure that knife is nice and sharp before carving time, just follow our knife sharpening guide to slice your turkey like a pro!

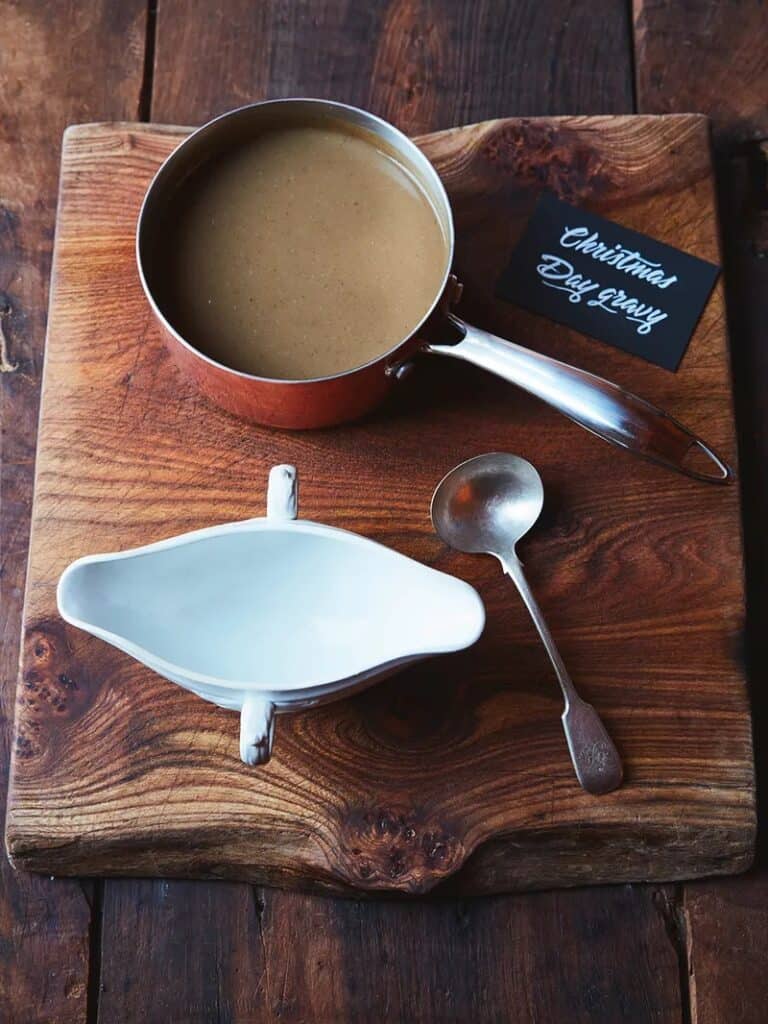

18. Jamie Oliver Gravy: “Christmas Day Gravy”

If you feel that roast turkey is incomplete without freshly prepared gravy to smother it in, we are right there with you. Though this Jamie Oliver Christmas Gravy recipe is specially designated for the holiday, the truth is, you can make and have freshly roasted turkey and gravy any time you like! It piggybacks on his easy turkey recipe (above), giving you a massive leg up on developing the rich flavor within your sauce.

As far as sauces go, gravy actually freezes quite well meaning yes, you can freeze your leftover turkey and gravy to have holiday meal vibes any night you like, or, get ahead on some meal prep!

19. Jamie Oliver Smoked Salmon Pasta: “Hot-Smoked Salmon Pasta”

If you want a dish that you can impress your friends with, without spending the entire day zooming around the kitchen, look for further. Jamie’s hot smoked salmon pasta dish is equal parts comfort food and impressive, yet low key at the same time.

If you’re anything like us, when it comes to pasta dishes there are almost always leftover ingredients. Thankfully, you can easily freeze leftover smoked salmon (hello breakfast bagel spread next weekend!) and our Ravioli with Sauteed Asparagus and Walnuts is the perfect way to use up those extra bunches of asparagus.

20. Jamie Oliver Mushy Peas: “Fish, Chips & Mushy Peas”

We all know they’re good for us, but sometimes, it can be tough to decide how to cook peas in a way that makes them tasty and enjoyable!

Jamie Oliver’s recipe for mushy peas is one such way, coming together simply with fresh mint, lemon, and some rich butter. The recipe calls for fresh podded peas, but this is a great time to use canned peas as many varieties already have a soft texture and salty-savory flavor that you're looking for. Jamie recommends serving these mushy peas as an accompaniment to fried fish and chips, alongside a pile of gherkins or pickles and don't forget the malt vinegar!

21. Jamie Oliver Chicken Pie: “Proper Chicken Pie”

With a name like “Proper Chicken Pie”, who could resist giving this one a shot! The homemade flaky pastry crust--which, we might add, only requires 2 ingredients and browns to perfection--is approachable enough that you don’t feel overwhelmed at the idea of making pie dough from scratch.

Underneath that deliciously crisp topper is a load of chicken, vegetables, and luxurious gravy. Make note that this recipe calls for white pepper which is decidedly distinct from black pepper, and salty, savory pancetta. Don’t try to use prosciutto here, as it will be too thin for chopping into chunks as instructed. See our full guide on the differences between pancetta vs. prosciutto!

22. Jamie Oliver Creamed Spinach: “Creamed Spinach with Cheddar and Oat Crumble Topping”

If there ever was a best way to get your leafy greens in, boy is this it. Yes, we’re talking about a spinach recipe that the whole family will happily chow down on--including the kids! It’s super convenient as well, as there is no need to stock up on fresh spinach for this one. Frozen spinach is what Jamie calls for here, and any of our favorite frozen spinach varieties would fill the role perfectly.

Not only does this creamed spinach recipe call for a healthy amount of grated cheddar cheese (No cheese grater? You can grate your cheddar in other ways!) and crème fraiche, but it also has a deliciously crunchy-crispy oat topping, making it feel like a treat when in reality, it's a healthy side dish.

23. Jamie Oliver Chicken Tikka Masala: “Easy Chicken Tikka Masala”

Not to be confused with butter chicken, which is a similar-looking yet distinct dish of its own, chicken tikka masala is likely to be one of the first dishes you might think of when it comes to Indian cuisine. And you can bet that Jamie’s version of this classic dish does it justice! Succulent chicken is cooked with an amazing array of toasted spices and rich tomatoes before getting a creamy-dreamy finish of coconut milk.

It is recommended that you use a mortar and pestle to crush the toasted spice mixture, but you could also use a spice grinder or a food processor for a bit more speed!

24. Jamie Oliver Prawn Toast: “Prawn Toast Toastie”

Aside from the delicious taste, one of the best things about this Prawn Toast recipe is that there are so many different ways you can go about pulling it off. Whether you have a favorite toaster at the ready (we recommend a toaster oven for this one) or you are achieving that perfectly golden-brown bread without a toaster, this prawn toast is amazingly easy.

Not to mention, there are less than 10 ingredients! With strong flavors like fresh ginger, savory sesame seeds, and umami-rich soy sauce, it doesn’t take much to whip up this tasty snack or meal.

25. Jamie Oliver Spaghetti Bolognese: “Spaghetti Bolognese”

When you’re in the mood for a true Italian classic, look no further than Jamie Oliver’s recipe for spaghetti Bolognese. Taking flavor and richness from both ground beef and bacon, this pasta recipe offers some real stick-to-your-ribs satisfaction.

The base of the sauce is intensified by the addition of super-tangy sun-dried tomatoes. However, if these aren’t exactly up your alley, reach for one of these sun dried tomato substitutes. Jamie recommends a food processor to get the texture of the sauce just right, but feel free to use your trusty upright blender or immersion blender if you have one!

Jamie Oliver FAQs

Let’s get into some more details about the brilliant life and career of Chef Jamie Oliver by answering some of your most pressing questions.

How Old is Jamie Oliver?

Jamie Oliver was born on May 27, 1975. This puts him at 47 years old--meaning he has achieved quite a lot in a relatively short time!

Where Does Jamie Oliver Live?

Jamie Oliver and his family live in Essex, England, in an estate known as Spains Hall. Described as a “historic mansion”, this property has a long and important history dating as far back as the year 1086!

How Many Michelin Stars Does Jamie Oliver Have?

This may come as a surprise, but Jamie Oliver actually does not hold any Michelin stars. Though his footprint on the culinary industry is undebatable, his various restaurants have met with mixed criticism over the years and none have ever made it into the Michelin guide.

Jamie Oliver Wife and Family

How many kids does Jamie Oliver have? He and his wife Juliette (better known by her nickname Jools) share five children! At times, the kids make appearances on his programming and are also frequently seen in his cookbooks, especially when topics of cooking for or with kids is at hand.

What is Jamie Oliver Net Worth?

At the latest report, Jamie Oliver’s net worth is a staggering $200 million, easily earning him a spot amongst the wealthiest chefs worldwide.

Final Thoughts on the 25 Best Jamie Oliver Recipes

We hope that this collection of a few (honestly, just a few as we've barely just scratched the surface!) of Jamie Oliver's best recipes has inspired you for your next meal. It can be easy to get stuck in a food routine when it comes to meal prep and busy schedules, but by perusing the works of a great chef, one is reminded just how many ingredients, dishes, and cuisines are actually out there!

By doing so you can gather new ideas, learn of new foods to try, and maybe even implement a new cooking technique into your repertoire. Now, go forth, and cook!

Leave a Reply